As Economic Diversity Increases, More Seniors Seek Out Financial Aid

February 11, 2022

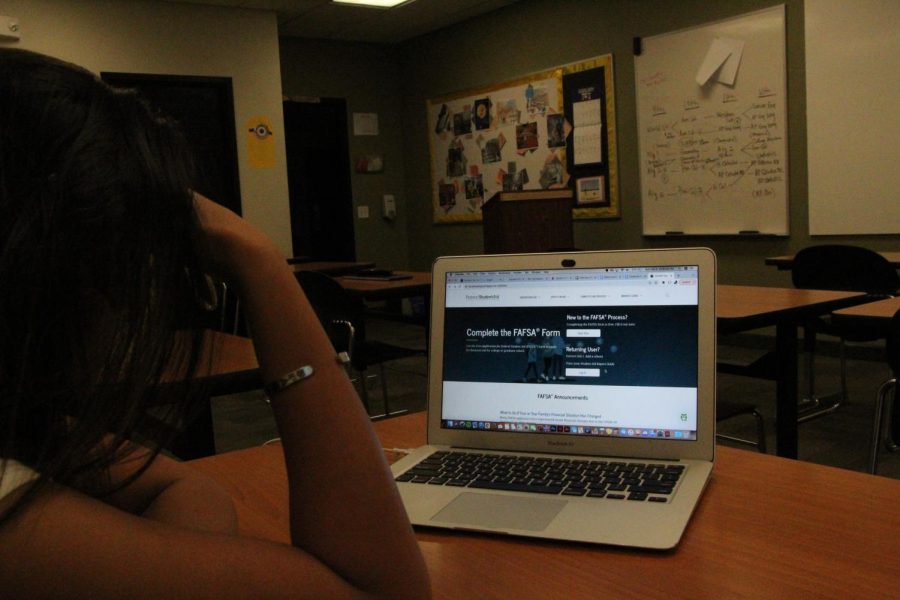

The college process can too often feel like driving on the road in a deep fog: having no idea where to go and where that road will lead you. A lot of that fog can be due to the financial overload that accompanies a secondary education, which can leave stu- dents scrambling for methods to ease that burden.

As the time for college applications comes to a close and the season of scholarship application finds its way into the second semester, stu- dents voice their desire for additional information about financial aid and scholarship opportunities.

Senior Grace Kearns described her college process as exciting but also stressful, definitely a popular combination of emotions that usually accompanies such a workload. Not only did Kearns have to think about getting into college, but she also had to think about how to pay for college after being admitted. “I went into freshman year knowing about FAFSA and the Bright Futures scholarships and having those in the back of my mind as sort of a big thing I have to do. I also am looking at scholarships, especially for colleges out of state because it can be more expensive and there aren’t in-state benefits like bright futures. Any sort of scholarship no matter the size will help,” she explained.

Director of College Counseling, Ms. Anna Wright, affirms the difficulty in having to worry about both aspects of the college process, saying, “it definitely is a process that is built for the privileged.”

Unfortunately, Kearns has felt that it has been difficult to retrieve information on the topic of scholarships and financial aid.

She said, “I can do my own research but it’s difficult for me to find information and actually understand it because college and college tuition are super intricate and complex and overall difficult to comprehend in an entire college situation feeling like you’re in the dark.”

Luckily, the college counseling team has methods, programs, and other resources to help students who are looking for additional means to pay for college.

College counselors’ first steps are to build the students’ college list, and should the student express their financial needs to pay for college, that is where the college counselors will begin to plan the best and easiest process to help that student.

Wright said, “We try to build in some schools where we know they have given kids merit money before. We know that we have to put in-state schools in their lists because we know bright futures would be a reality for most of our students who may not get the money they need from their other schools. So that was part of the plan.”

While in-state schools are definitely good options for those who are looking to relieve the financial burden of college payment, college counselors understand that sometimes students who convey those financial needs do not necessarily want to stay in-state. So they also make it a point to look at specific colleges on a website called College Transitions Average Merit Aid. This website shows college counselors the best schools to apply to that meet a very high percentage of need-based money as well as merit-based money in order to maximize students’ relief.

Not only do the college counselors help students directly in the process but they also hold programs that are open to anyone who is beginning to think about how to pay for college. One such program is the annual UMi- ami visit from Chris Magnan, the Senior Advisor of Financial Literacy. This program is open to 8th graders and above, allowing students and parents a running start to get ahead in their payment plans for college.

Students are understandably scrambling to pay for college, as tuition is often on the rise. Fortunately, Benjamin college counselors are there to help students from the beginning to the end.